Investing during periods of volatility can be difficult, especially when markets seem arbitrary.

9 Charts Every Investor Should See

Investing during periods of volatility can be difficult, especially when markets seem arbitrary.

Environmental, social, and governance, or ESG, investing is a hot trend, but retail investors are unfamiliar with the approach and have a hard time explaining what it means. About one in four people believes the acronym stands for “earnings, stock, growth,” according to a new study.

Fund managers have been tripped up by global stocks and bonds falling in tandem in the first quarter.

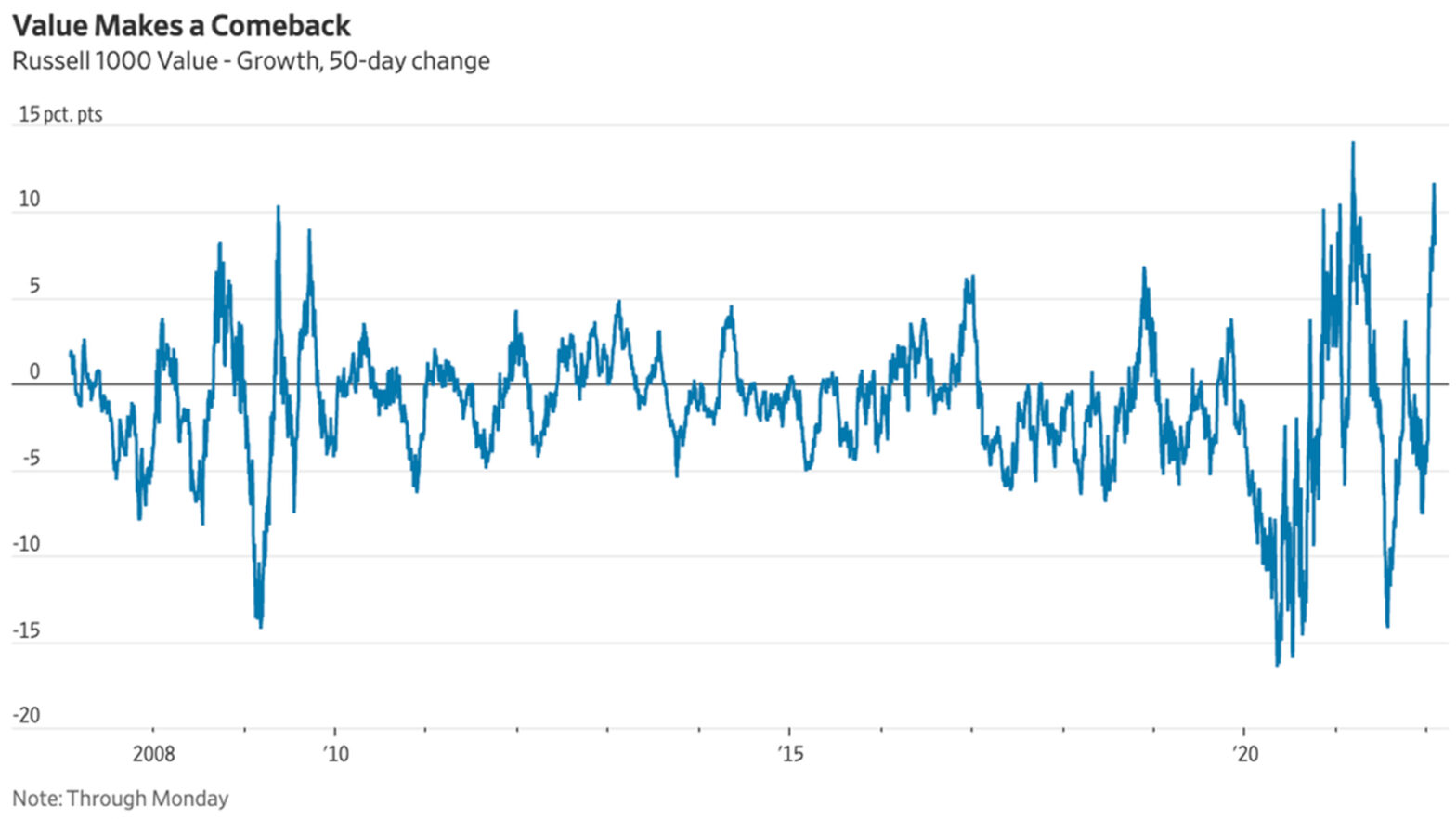

Value investing—buying stocks that are cheap on measures such as earnings or book value—is having a renaissance. Up to last Thursday, large value stocks beat more expensive “growth” stocks by the most of any 50-day period since the technology bubble burst in 2000-01, with the exception of the post-vaccine rebound early last year.